Audit Assertions for Purchases

One high risk of inventory is that the company bought the inventory but the purchases were not recorded into the inventory account. Information that the auditor must report as part of a prescribed audit.

Audit Procedures Types Assertions Accountinguide

Security policies define the objectives and constraints for the security program.

. This could be the result of intentional fraud or. Thus in this section we will take some assertions that we usually test in. For a detailed list of accounting audit definitions see PCAOB document AU 801.

And retained earnings comes from the earnings or losses on the income statement. In this post Ill answer questions such as how should we test accounts payable. See page 64 and Chapter 16 of the notes assertions relate to classes of transactions eg.

A value measurement for. The inventory is considered to be a hazardous item in the balance sheet. Collectively all classes of transactions account balances and their related disclosures make up the financial statements.

These aspects of audit risk are sampling risk and nonsampling risk respectively. This includes details collected during an audit that allow an. Put the relevant assertions next to each audit stepthis makes the connections between the RMMs at the assertion level and the audit steps clear.

The risk even increases if the business operates in the manufacturing sector. First its easy to increase net income by not recording period-end payables. A statement of objectives rules practices or regulations governing the activities of people within a certain context.

8 Audit Risk describes audit risk and its components in a financial statement audit the risk of material misstatement consisting of. Inventory in the Balance Sheet. These are compliance requirements that are subject to the compliance audit.

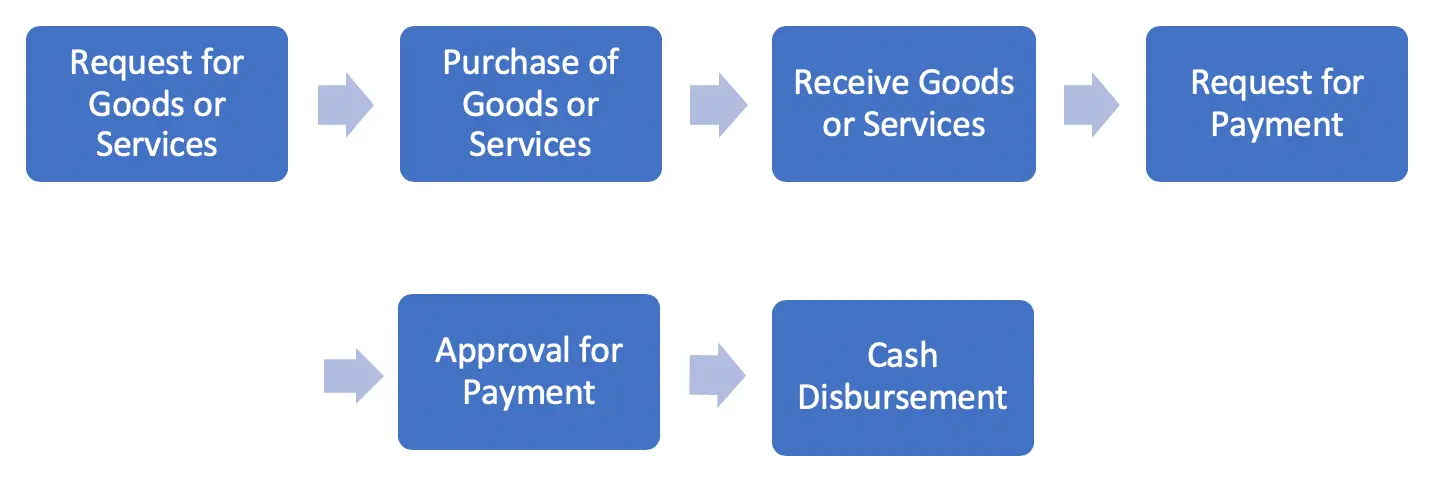

The reason is that business operating in manufacturing segment is expected to have a greater quantity of raw material work in process and the finished goods. In order to audit the accounts payable it requires to use the combination of analytical procedures and tests of detail or substantive audit procedures for accounts payable. Typically we perform the audit of accounts payable in conjunction with the audit of purchases.

Sales purchases and account balances eg. If we disregard stock purchases and sales equity is usually the accumulation of retained earnings. NIST Glossary Security Policy.

As auditors we usually audit inventory by testing the various audit assertions including existence completeness rights and obligations and valuation. Statements rules or assertions that specify the correct or expected behavior of an entity. Second many forms of theft occur in the accounts payable area.

And should I perform fraud-related expense procedures. Accounts payable is usually one of the more important audit areas.

The Completeness Assertion And Purchase Cutoffs Youtube

Audit Expenses Assertions Risks And Procedures Wikiaccounting

Audit Expenses Assertions Risks Procedures Accountinguide

Audit Expenses Meaning Audit Assertions Risks Substantive Procedures Carunway

Belum ada Komentar untuk "Audit Assertions for Purchases"

Posting Komentar